salt tax deduction limit

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. The latest SALT plan would remove the current 10000 cap part of the 2017 tax overhaul entirely for those making less than 400000 a year.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

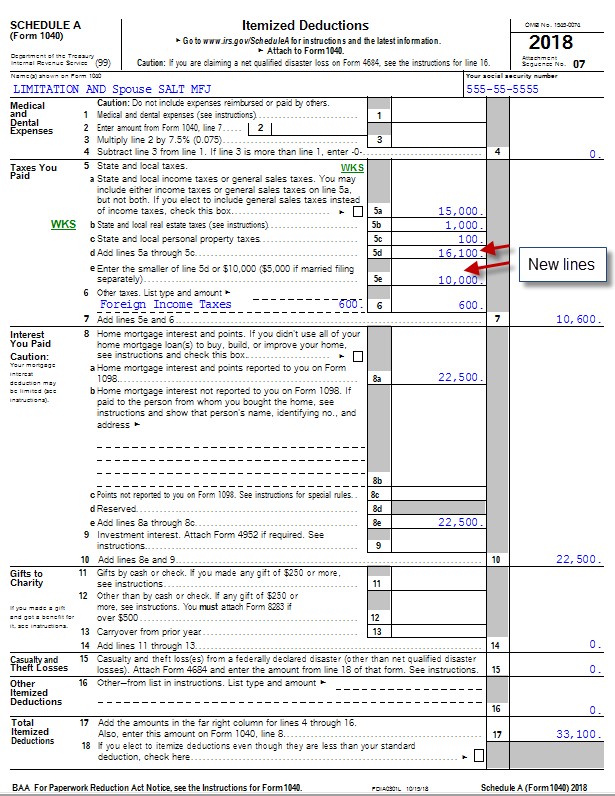

This limit on state and local tax is often abbreviated to the SALT deduction cap and was temporarily set at 10000 for single and married filers and 5000 for married couples.

. For spouses that file separate tax returns the SALT deduction is limited to 5000 per person. The federal tax reform law passed on Dec. This will leave some high-income filers with a higher tax bill.

This deduction is a below-the-line tax deduction only available to taxpayers who itemize Its only available to taxpayers who have eligible state and local taxes to deduct. The SALT deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes. The most recent version of the Build Back Better Act passed by the House of Representatives increased the current 10000 deduction limit to 80000 and 40000 for.

The SALT state and local tax cap doesnt allow people to deduct more than 10000 of specific state and local taxes from their federal income taxes through 2025. While the federal standard deduction nearly doubled there have. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000.

In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the. How the SALT deduction works. Under the SALT Act people making less than 400000 would once again be permitted to deduct all state and local taxes on their federal income tax returns provided they.

And Maryland in trying to strike down the 2017 limit known as the SALT cap which. Starting with the 2018 tax year the maximum SALT deduction became 10000. As President Joe Biden and policymakers in Congress consider changes in tax policy over the coming year the fate of the 10000 state and local tax SALT deduction cap.

SALT Deduction Limit 2022 BBB Act New limits for SALT tax write off. According to the Tax Policy Center 16 of tax filers with income between 20000 and 50000 claimed the SALT deduction in 2017 compared to 76 for tax filers with income. The Tax Cuts and Jobs Act imposed a 10000 limit on the SALT deduction so regardless of how much you actually pay in state and.

What is the new SALT. SCOTUS swats away SALT cap challenge that limits tax deductions in New York Maryland. Learn More at AARP.

The Tax Cuts and Jobs Act of 2017 changed a lot of things about the US. There was previously no limit. Theres now a cap on your SALT deduction.

Spouses and the State and Local Tax Deduction Spouses Filing Separately. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. Because of the limit however the taxpayers SALT deduction is only 10000.

22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return. Congressional Democrats are negotiating changes to the 10000 cap on the federal deduction for state and local taxes known as SALT. Maximum SALT Deduction.

52 rows The SALT deduction allows you to deduct your payments for property.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

State And Local Tax Salt Deduction Salt Deduction Taxedu

The Buried Boon To The Wealthy In The Democrats Tax Plan The Economist

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Who Can Take The New Business Tax Deduction Even Tax Experts Aren T Sure Utica New York Emotional Wellness National Sleep Foundation

Salt Deduction Proposed Regulations Would Make State Tax Charitable Credit Workarounds Useless Trị Mụn Nau Quạ

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

How Would Repeal Of The State And Local Tax Deduction Affect Taxpayers Who Pay The Amt Full Report Tax Policy Center

The Tax Break Down The State And Local Tax Deduction Committee For A Responsible Federal Budget

How Tax Reform Affects The State And Local Tax Salt Deduction Tax Pro Center Intuit

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

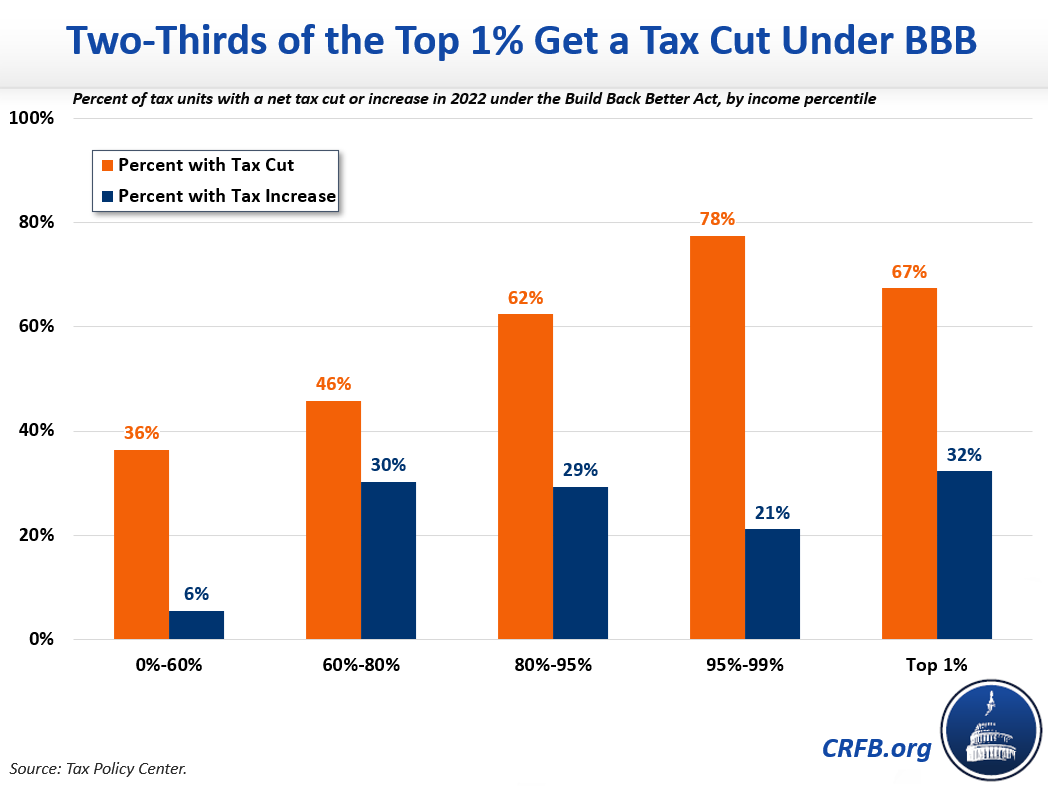

Two Thirds Of The One Percent Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)