colorado estate tax exemption

1 inheritance taxes which are. So you are aware that there is no estate tax in Colorado.

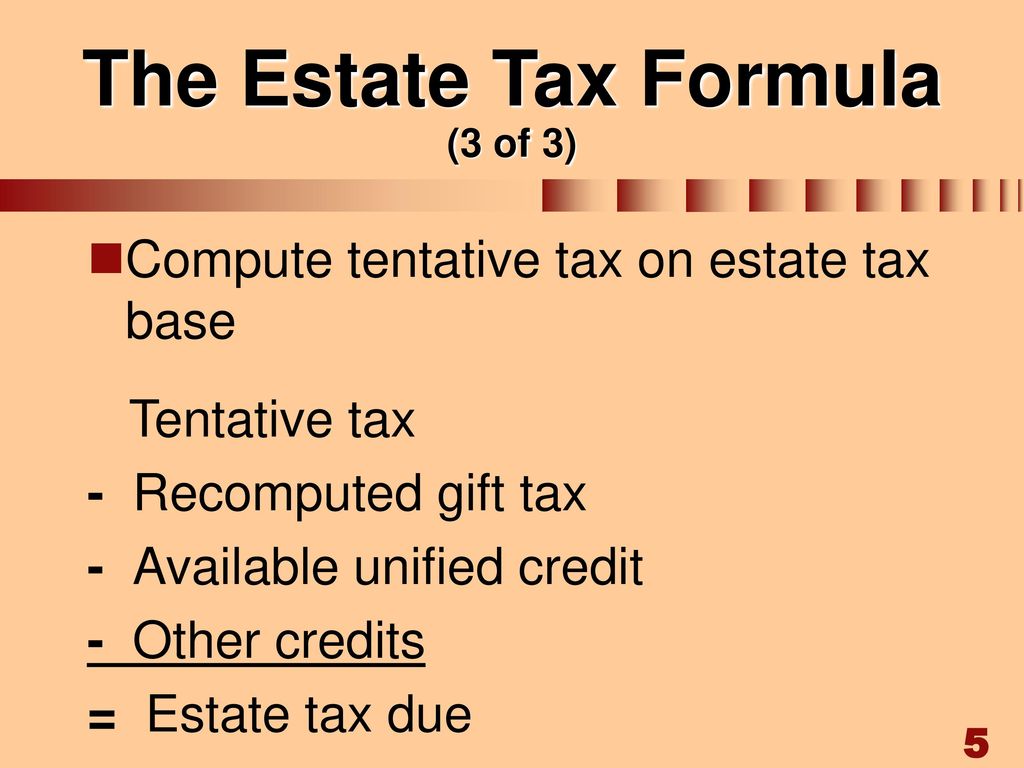

A New Era In Death And Estate Taxes

The Exemptions Section is responsible for determining qualification for exemption from property taxation for properties that are owned and used for religious charitable and private school.

. Colorado estate tax planning. The exemption for that tax is 1170 million for deaths in 2021 and 1206 million in 2022. The state constitution authorizes the general assembly to lower the maximum amount of the actual residential value of residential real property that is subject to the senior.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Currently the estate tax has an exemption amount of over 5 million and a tax rate of 35. In 200 Colorado voters amend6 section 35ed of article X of the Colorado Constitution.

Residential Properties Specific Forms For Charitable-Residential Properties Additional Forms Late Filing Fee Waiver Request Remedies for. Estate income tax is a tax on income like interest and dividends. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

The state of Colorado requires you to pay taxes if youre a resident or nonresident that receives income from a Colorado source. The Colorado House of Representatives approved legislation Thursday to exempt period products and diapers from sales tax sending it to the state Senate for consideration. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

However Colorado residents still need to. There is no estate or inheritance tax collected by the state. For 2021 this amount is 117 million or 234 million for married couples.

Certain products and services are exempt form Colorado state sales tax. The state income tax rate is 45 and the sales. Estate tax can be applied at.

Seniors andor surviving spouses who qualify for the property tax exemption must submit an. Colorado state tax laws requiring estate or inheritance tax are pretty simple. Ad The Leading Online Publisher of National and State-specific Legal Documents.

For more information contact the Colorado Division of Veterans Affairs at. If the Colorado Department of Revenue determines that an organization qualifies the organization will receive a Certificate of Exemption that authorizes it to purchase items and services. Note however that the estate tax is only applied when assets exceed a given threshold.

View tax exemption forms for Disabled Veterans. The fee is calculated at the rate of 001 for each 100 or major fraction of the total consideration paid by the purchaser. Complete the Exemption from Real Estate Transfer Tax Application using the online form.

While federal law still imposes estate taxes on certain estates only. Colorado provides for several exemptions from the. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

You are the current owner of record and you have owned the property for at least 10 consecutive years prior to January 1 of the tax year for which you. Fifty percent of the first 200000 in actual property value is exempt from property taxation. Some states have decided to recently enact statutes to tax estates based on a.

Carefully review the guidance publication linked to the exemption listed below to ensure that. The amendment and subsequent legislation expanded the senior property tax exemption to include. Instant Download Mail Paper Copy or Hard Copy Delivery Start and Order Now.

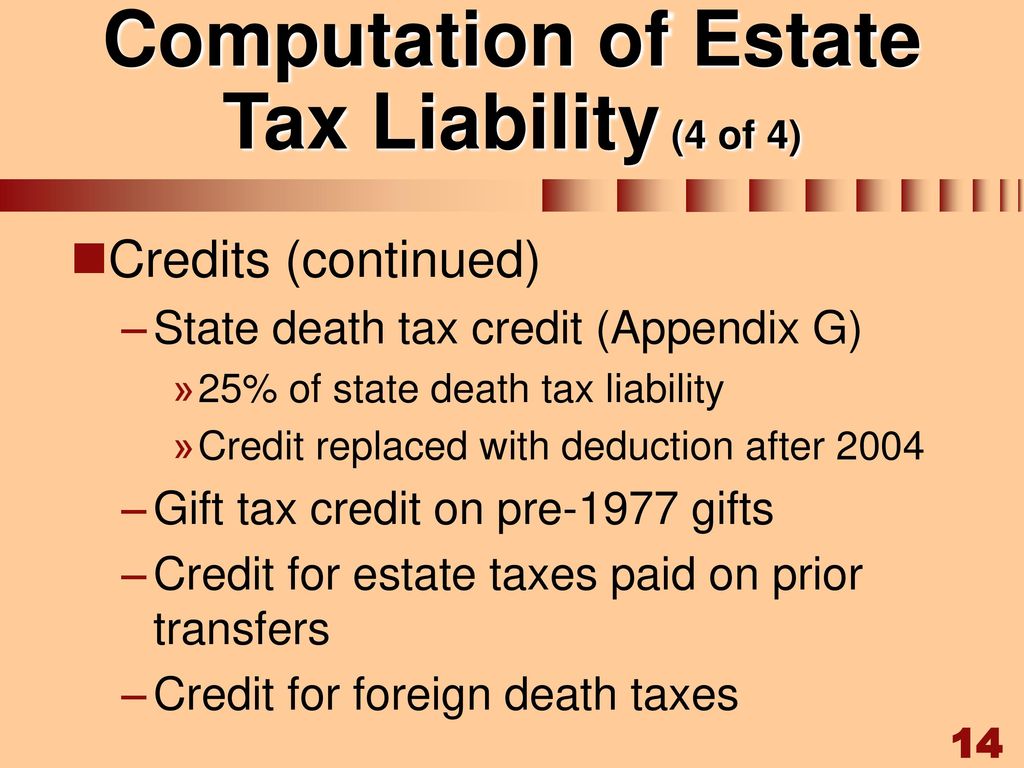

There are three types of taxes imposed on the transfer of assets at death. Application for Property Tax Exemption. Colorado estate tax applies whether the property is transferred through a will or according to Colorado intestacy laws.

Please note this form does not work in Internet Explorer. Even though there is no estate tax in Colorado you may still owe the federal estate tax. Senior Property Tax Exemption Short Form and Instructions.

The Colorado estate tax is based on the state.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Chapter 13 The Estate Tax Ppt Download

Chapter 13 The Estate Tax Ppt Download

Colorado Estate Tax Everything You Need To Know Smartasset

Wsj Tax Guide 2019 Estate And Gift Taxes Wsj

Why Billions Of Dollars In Estate Taxes Go Uncollected Estate Tax Tax Attorney Estate Planning

Don T Let Higher Estate Tax Exemptions Make You Complacent About Transition Planning Valuation Buysellagreements Bus Estate Tax Tax Exemption How To Plan

Colorado Estate Tax Everything You Need To Know Smartasset

How To Avoid Estate Taxes With A Trust

Colorado Estate Tax Everything You Need To Know Smartasset

Indiana Estate Tax Everything You Need To Know Smartasset

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

State Estate And Inheritance Taxes Itep

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Equestrian Estate For Sale In Burnet County Texas Remarkable Property Offering 18 95 Meticulously Manicur Farm Gate Entrance Farm Entrance Equestrian Estate

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Estate And Income Tax Liabilities For A Sample Of Estate Tax Decedents Download Table

Recent Changes To Estate Tax Law What S New For 2019

How Do State Estate And Inheritance Taxes Work Tax Policy Center